Futa suta calculator

Weve put in some very standard rates for FICA FUTA and SUTA for display purposes. Without a streamlined and reliable payroll system in place businesses may face tough consequences including poor employee retention minimal.

Futa Tax Overview How It Works How To Calculate

Department of Labor Frances Perkins Building 200 Constitution Ave NW Washington DC 20210 wwwdoletagov Telephone.

. See how FICA tax works in 2022. Kerzdenn Kowalchuk Vizeer Services LLC As part of an entrepreneurship network Im always searching for platforms that are ideal for startups. It fits perfectly in line for business startups that need something legit in place but dont need larger more complicated payroll platforms.

It also pays the administrative costs of the state reemployment. Employment and Training Administration US. To determine the true cost of your employee youll need to take into account how many hours they work each week and how many weeks they work each year.

Promptly respond to each. How to Calculate Payroll Taxes with Gusto. If you are a liable employer under state law you may also be required to pay under the Federal Unemployment Insurance Tax Act FUTA.

Six to 10 years of active service Zone C. The cost will be displayed for one hour of labor. 10 to 14 years of service For example say that the US.

You pay SUTA taxes up to the 7000 state limit for Barry and Jordan. 21 months to six years of active service Zone B. Employee 3 has 37100 in eligible FUTA wages but FUTA applies only to the first 7000 of each.

Taxes require accuracy and a small mistake in your calculations can lead to disaster in the future. This is especially true if you have a lot of employees. This federal tax helps finance South Dakota Department of Labor Programs such as placement labor market information and training of workers to meet industry needs.

Begin your calculation by multiplying the monthly chaplain salary by the number of years for which he is re-enlisting like this. While there are many different elements of running a business one of the most important is payroll. Direct reports are employees who as the term implies report directly to someone who is above them in the organizational hierarchy often a manager supervisor or team leader.

Department of Defense has classified chaplains in Zone B as eligible for SRB. The calculator provided on this page is designed to only give simple rough estimates and should not ever be used to calculate exact payroll taxes or any other financial data. Your business is unique and many things can factor into individual tax situations.

Another term for direct reports is subordinates. If you have a salary of 30000 in Minnesota that means a total unemployment of 1206 SUTA and FUTA. A summary dismissal of employment often simply called a summary dismissal or instant dismissal is the immediate termination of an employee due to their behavior the basis of which is gross misconductWith a summary dismissal the employee can be terminated without notice and without a payment in lieu of notice.

Enter those two numbers in the GL Rate and WC Rate of the calculator. How to Use Clocksharks Labor Cost Calculator. High turnover lowers morale increases costs and causes inefficiency.

Employee turnover is harmful to any business and costs on average 15000 per person. Employers remit withholding tax on an employees behalf. So your FUTA would now become 420 7000 6 saving you roughly 786 not bad.

I really like the simplicity and price of Wagepoint. Since Maya made less than the state limit her SUTA wages are 3000. These fees depend on how late FUTA SUTA taxes were filed.

Although its manageable to calculate payroll taxes manually this isnt recommended. FUTA SUTA unemployment insurance On the other hand SUTA sometimes also referred to as SUI State Unemployment Insurance is calculated in a different way and can change significantly across states. Theyre used for oversight of state unemployment programs.

Like weve discussed if you are not covered by a state unemployment program the federal program sets a higher rate of 6. This adds up to the total payroll taxes you must pay. Generally speaking however SUTA oscillates between 27 and 34.

The FUTA tax liability is based on 17600 of employee earnings 4900 5700 7000. Add your annual overhead costs such as property and payroll taxes insurance equipment or space rentals supplies benefits and any other. During times of high unemployment states may borrow from FUTA funds helping provide benefits to locally unemployed people.

FICA tax is a 62 Social Security tax and 145 Medicare tax on earnings. FUTA taxes are administered at the federal level. Payroll is best defined as the total of all compensation an employer must pay to its employees for a specified range of time.

What Is a Summary Dismissal of Employment. Repeat as many times as needed to see the cost of one hour of labor for each labor classification your employees perform. The information shared on this page is not intended to provide tax or legal advice.

State Unemployment Taxes SUTA An employees wages are taxable up to an amount called the taxable wage base. Its not only time. Low turnover will allow an employer to pay minimal FUTA SUTA taxes.

Solved Calculate Employer S Total Futa And Suta Tax As Tclh Chegg Com

Calculating Suta Tax Youtube

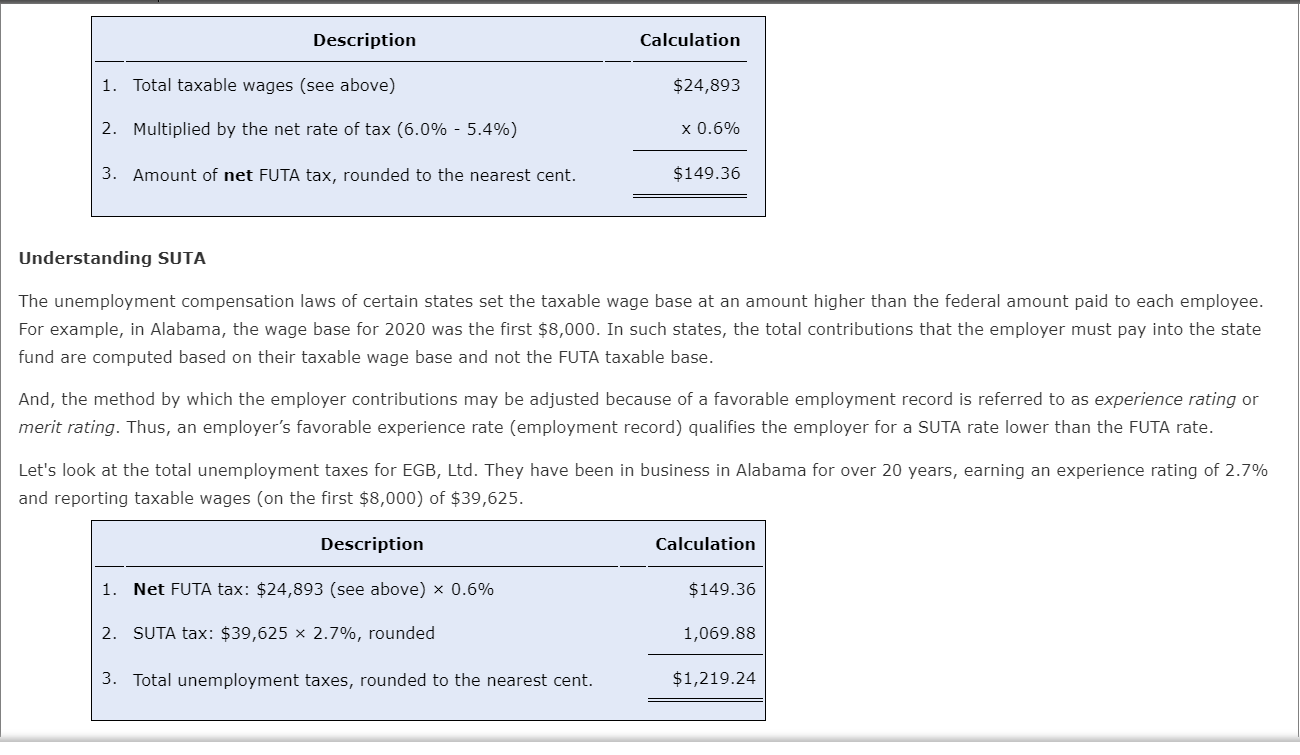

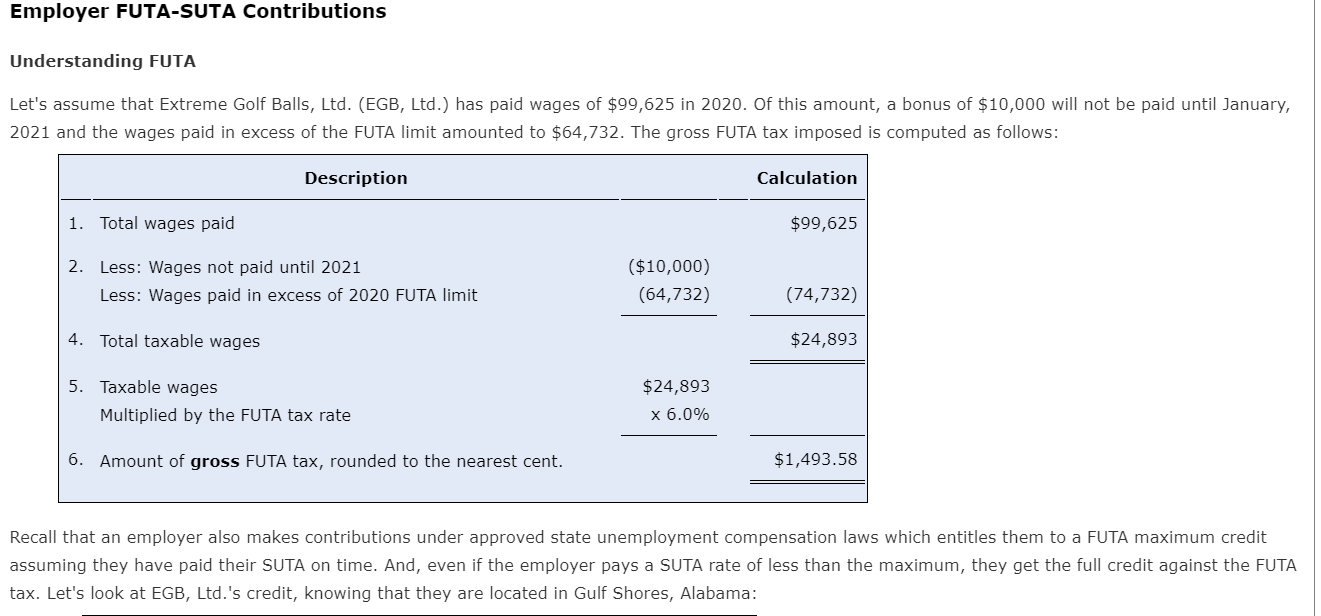

Employer Futa Suta Contributions Understanding Futa Chegg Com

Need An Excel Formula To Calculate Suta Tax On Monthly Wages With A Microsoft Community

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Formulate If Statement To Calculate Futa Wages Microsoft Community

How To Calculate Unemployment Tax Futa Dummies

Payroll Tax Calculator For Employers Gusto

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Employer Futa Suta Contributions Understanding Futa Chegg Com

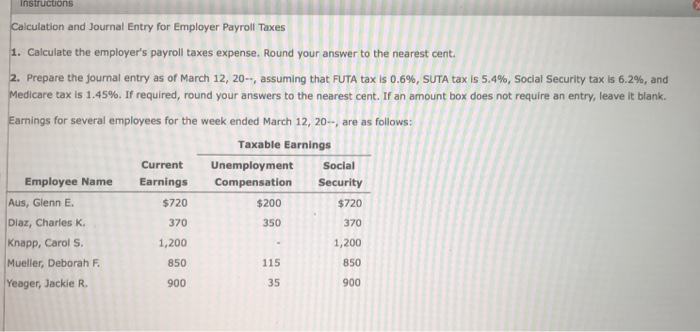

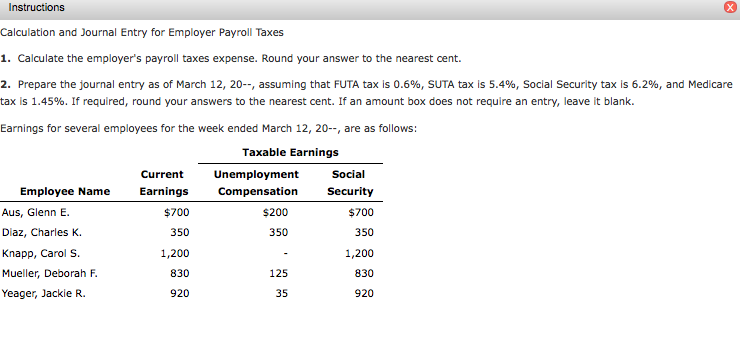

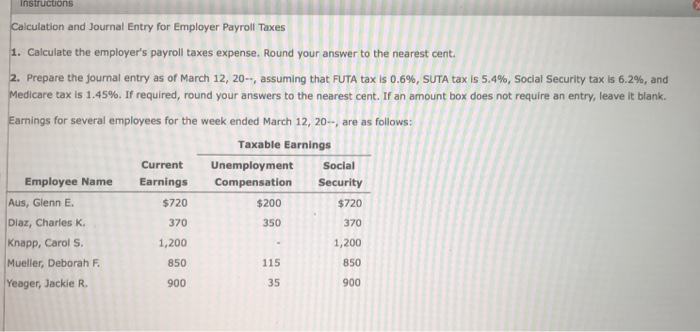

Solved Instructions Calculation And Journal Entry For Chegg Com

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

Solved Instructions Calculation And Journal Entry For Chegg Com

Calculating Futa And Suta Youtube

Need An Excel Formula To Calculate Suta Tax On Monthly Wages With A Microsoft Community

Federal Unemployment Tax Act Calculation Futa Payroll Tax Calculations Futa Youtube